Enterprise Reconciliation

Enterprise Reconciliation

Effortlessly streamline your financial operations with our cutting-edge enterprise reconciliation platform.

Simplify the complexities of data matching and achieve optimal accuracy, all while keeping your business compliant, efficient, and ahead in the ever-evolving financial landscape.

Bwa Business

Why Our Enterprise Reconciliation Solution

Our cutting-edge reconciliation platform provides businesses with a centralized access point, streamlining the matching of data records across multiple systems and sources. With our Reconciliation solution, companies can effortlessly manage their financial integrity, eliminating discrepancies, reducing manual errors, and ensuring compliance—all through a single, secure, and intuitive platform.

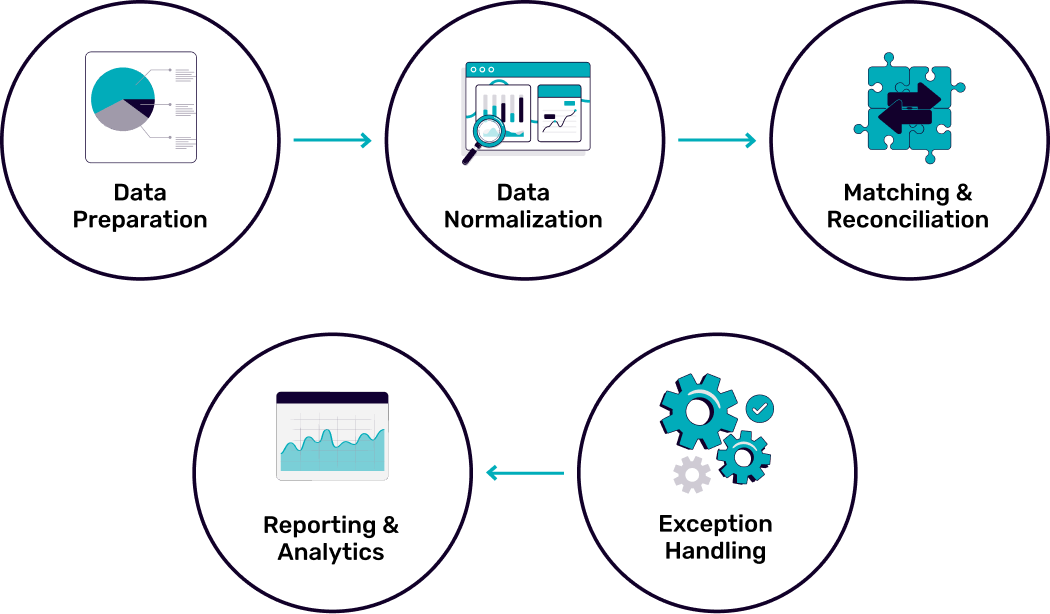

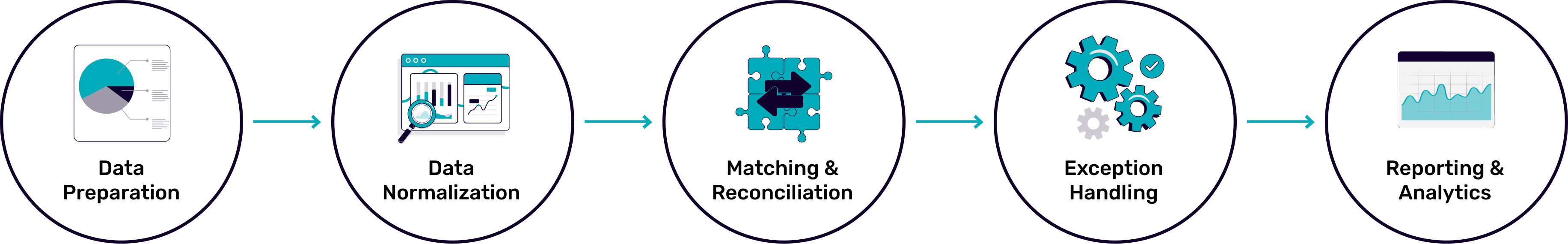

Our Powerful Features

Data Acquisition

Integrate data from multiple sources such as bank transactions, POS systems, and third-party platforms effortlessly in one place. Featuring robust error detection, customizable rules, and advanced data handling for accurate alignment and reconciliation readiness.

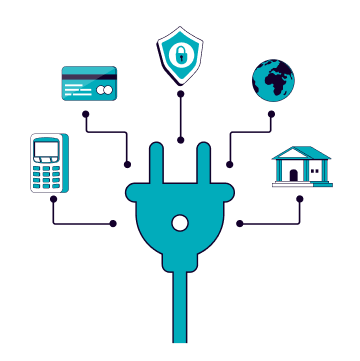

Seamless Integrations

Easily connect and harmonize data across diverse systems including retail applications, POS networks, financial institutions, banks, payment gateways, and third-party platforms using API, file drops, and scheduled data pulls.

Flexible Reconciliation

Design and schedule customized reconciliation streams to fit your business needs. Whether you’re dealing with varied multi-directional matching scenarios, our platform handles it all with precision.

Custom Matching Rules

Employ advanced matching techniques where required, such as fuzzy matching with tolerance levels, rule-based exception detection, and more to ensure every discrepancy is accurately identified and addressed.

In-Transit Management

Handle in-transit transactions with configurable deadline levels for each data source, ensuring accurate financial reporting even for delayed or pending transactions.

Exception Management

Effectively manage and resolve exceptions with rule-based detection, aging tracking, automated and manual matching options, ensuring all discrepancies are addressed promptly.

Advanced Analytics & Reporting

Generate detailed reports and analytics to monitor reconciliation performance, exception resolution timelines, and overall financial health.

Secure Data Handling

Protect your financial data with end-to-end encryption and regulated data controls, ensuring that all sensitive information is securely processed and stored.

Enhanced Accuracy and Efficiency

By automating data matching and reconciliation tasks, businesses can eliminate errors associated with manual processing and optimize resource allocation.

Comprehensive Data Access and Integration

The platform seamlessly integrates with retail systems, detailed banking transactions, MADA retail merchant data, and audit data, providing comprehensive access to critical financial information. This holistic view enables better decision-making and operational transparency.

Customizable Reconciliation Streams

BwaTech Reconciliation offers tailored tools to enhance financial operations and streamline workflows according to specific business needs. Customize reconciliation streams for various transaction types, including POS, cash, online transactions, and loyalty programs, ensuring flexibility and adaptability.

Proactive Exception Management

Stay proactive with live dashboards and control rooms that facilitate real-time exception handling.

Efficient Transaction Management

Effectively manage missing or unmatched records with configurable tolerance deadlines for each data source type. This feature ensures that financial reporting remains accurate and uninterrupted, minimizing the impact of discrepancies on business operations.

Real-time Analytics and Reporting

Gain instant insights into financial performance and trends with real-time analytics provided by BwaTech Reconciliation. Make quick, informed decisions using dynamic reporting tools that consolidate essential data in user-friendly formats.

User-Friendly Interface

Enjoy a user-friendly portal that centralizes all essential financial management tools, simplifying operations and improving overall efficiency. BwaTech Reconciliation’s intuitive interface enhances user experience, empowering businesses to leverage advanced functionalities effortlessly.

Industry Applications

Asked Questions

1. Is the enterprise reconciliation platform suitable for small businesses?

Absolutely. The platform is designed to support businesses that process a high volume of transactions, making manual reconciliation time-consuming and prone to errors. The focus is not on company size or revenue but on how many transactions need to be reconciled.

2. Can we reconcile non-financial records using the platform?

Yes, the platform is versatile enough to reconcile any type of record, financial or non-financial. As long as there is a clear logic for matching records, the platform can handle it. For example, loyalty points or other non-financial metrics can be reconciled effortlessly.

3. Can the platform automatically acquire data from our internal systems?

Yes, instead of manually uploading data, we can integrate directly with your systems as long as they have an available API or data interface. This allows for seamless data acquisition without the need for manual intervention.

4. Can the platform reconcile international business transactions if my acquiring bank is outside KSA?

Yes, the platform supports reconciliation across multiple banks, whether local or international. You can create multiple reconciliation streams, and for international transactions, data can be acquired via file uploads or through automated integrations.

5. How does the platform handle discrepancies and exceptions?

The platform detects and flags discrepancies such as mismatches, missing records, or in-transit transactions. These exceptions are then categorized and can be resolved through automated processes or manual intervention, depending on business rules.

6. Is there a limit to the number of reconciliation streams we can set up?

No, there is no hard limit to the number of reconciliation streams you can configure. You can set up streams for different transaction types, channels, and geographies to match your business's unique operational needs.

7. Does the platform provide real-time reconciliation capabilities?

While the platform isn't strictly real-time for all processes, it offers near real-time reconciliation based on your data acquisition schedules. You can customize the frequency of reconciliations and receive live updates on any discrepancies detected.

Would you like further assistance?

Count on our dedicated support team to assist you every step of the way.

Investment

Fund Marketplace